Q3 2025 Market Commentary: What Tariffs?

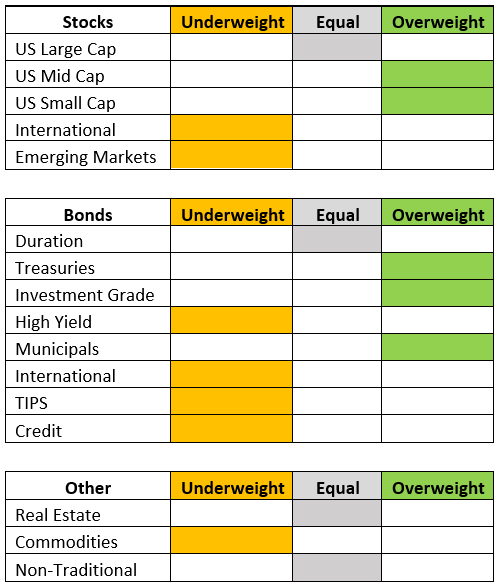

This information is meant to be a commentary regarding Consilio Wealth Advisors’ views on the relative attractiveness of different areas of the market, contrasted with our current asset allocation strategy for the near term, 12-18 months.

These views are always made in the context of a well-diversified portfolio and are not meant to be a recommendation to buy into or sell out of a particular area of the market. These views can and will change as new information becomes available, and we will periodically update this brief to keep you informed of changes.

Second Quarter Review

So far, tariffs have been more bark than bite—at least according to the stock market. After a brief dip, equities have clawed their way back toward all-time highs set in February. Despite the headline noise, Wall Street appears to be treating the tariff threat as background static.

Still, don’t get too cozy. The uncertainty around tariffs is very real, especially for importers and retailers juggling unpredictable costs. Just ask anyone managing inventory—they’ll tell you that "stable pricing" might as well be a fairy tale right now.

Tensions with China have eased, which markets welcomed with open arms. Empty-shelf panic has subsided, and investors are treating tariffs more like a geopolitical sideshow—similar to how they treat short-term flare-ups like regional conflicts or sanctions. Markets might wobble briefly, but they tend to move on quickly.

Inflation: A Mixed Bag

Despite all the noise, tariffs haven’t shown up meaningfully in inflation data—yet. Inflation has actually been running below expectations, mainly thanks to falling oil prices dragging the CPI (Consumer Price Index) lower. Airline fares also dipped, giving consumers a temporary break.

But dig a little deeper, and prices are still climbing in most categories:

Top CPI Gainers (YoY)

Natural gas (piped): +15.3%

Meats, poultry, fish, and eggs: +6.1%

Tobacco and smoking products: +6.3%

Motor vehicle insurance: +7.0%

Energy services: +6.8%

Top CPI Losers (YoY)

Gasoline (all types): -12.0%

Energy commodities: -11.6%

Airline fare: -7.3%

Fuel oil: -8.6%

Fruits and vegetables: -0.5%

Apparel: -0.9%

We may be entering a phase where inflation takes a backseat to its often-forgotten cousin: deflation. Yes, believe it or not, central banks struggled for years post-2008 to get inflation above 1.5%. Technology was a key deflationary force then, and now AI is accelerating that trend.

We’re already seeing tech firms trimming junior developer roles. AI won’t just eat tasks—it’s likely to climb the productivity ladder, which may lead to job displacement in other sectors too. But remember, automation doesn’t always mean elimination. ATMs were supposed to replace tellers. Instead, tellers adapted and banks improved service. We expect more of a job shift than a jobs apocalypse.

Meanwhile, retail traders keep “buying the dip”, treating tariff fears as buying opportunities. Whether it’s boldness or just the dopamine hit of a discount, they’ve turned the sell-off into a speed bump. Being oblivious to risk in the short term can help long term investors and it looks like the retail traders were right. Regardless, long term investors should get invested and stay invested.

Bonds & Rates: Cooling Off Without Cracking

Treasury yields have come off their April highs. The 10-year Treasury, which started 2025 around 3.88%, shot up above 4.5% before retreating to roughly 4.26%. That pullback came on the heels of cooler-than-expected April and May inflation reports, which rekindled hopes of a Fed rate cut later this year.

The Fed, though, is playing it cool. In its June meeting, officials forecast just two rate cuts in 2025. Still, Chair Powell’s tone was more dovish than before, hinting that the Fed is open to easing if growth slows or disinflation (prices still going higher but at a slower rate) continues.

This helped flatten the yield curve, with longer-dated Treasuries seeing steady demand. Treasury auctions—where investor appetite is measured—have remained solid. A bid-to-cover ratio of 2.0 or higher means demand is healthy. The latest results? 2.5 to 1. That’s a strong vote of confidence in U.S. debt, even with higher deficit chatter.

The real worry? If that ratio dips below 1, signaling buyers are drying up. But for now, there’s no fire alarm ringing in the bond market.

Looking Ahead: What’s Real vs. What’s Reported

Here’s the tricky part: even if tariffs stay in place and raise prices, inflation may not show up in the data. How? Because inflation measures the rate of change—not the level. If prices jump once and then stay put, inflation data says, “All good!” even if your wallet screams otherwise.

In that scenario, companies pass along higher costs, and consumers either keep spending or start substituting. We're already seeing signs of the latter in the form of declining airfare demand.

And while the Fed’s focus is on price stability, consumers care about price pain. Unfortunately, the former doesn’t always capture the latter.

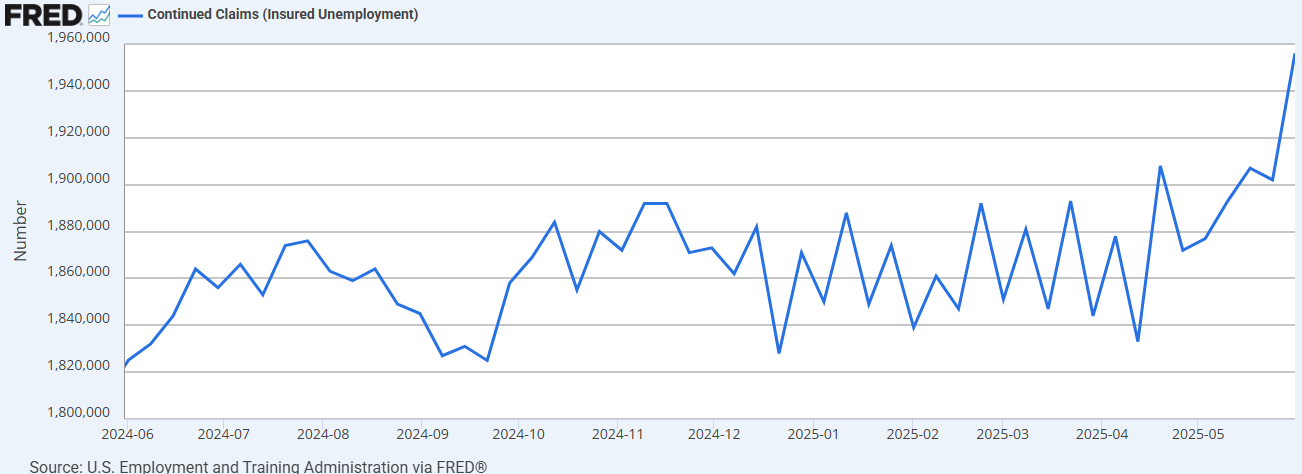

We expect some demand destruction ahead—consumers may simply walk away from purchases if sticker shock returns. We endured the price spikes of 2022, but with jobless claims ticking up and layoffs spreading beyond tech, we’re not sure buyers have it in them for another round.

The Fed has penciled in one cut for 2025, but needs more clarity on how tariffs affect the real economy. Once a rate cut happens, money market yields will drop quickly. That’s a heads-up for anyone riding the current yield wave.

Final Thought: Don’t Dismiss Treasuries

Despite all the doom-and-gloom headlines, Treasuries remain solid. The U.S. still enjoys a reputation for being the world’s most reliable borrower. The debt level may be rising, but repayment risk isn’t. Don’t let the noise talk you out of a historically stable asset class—especially if rates begin to fall.

DISCLOSURES:

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

This document is for your private and confidential use only and not intended for broad usage or dissemination.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of CWA strategies are disclosed in the publicly available Form ADV Part 2A.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. You cannot invest directly in an Index.

Past performance shown is not indicative of future results, which could differ substantially.

Consilio Wealth Advisors, LLC (“CWA”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where CWA and its representatives are properly licensed or exempt from licensure.